We type, tap, and swipe our phone's screen over 2000 times per day. It is almost as if our phones have become another appendage. So, it should not come as a surprise that by 2019, according to Gartner, 32% of the global adult population, or about 1.7 billion of us, will conduct most of our banking on our mobile device.

Even with such a dramatic shift occurring in banking channels, implementing innovative mobile banking products is seen as a requirement by only 15% of banks according to CSC. This mindset provides financial institutions who do focus on the customer experience of their mobile apps an open opportunity to differentiate from their peers.

To help your mobile apps stand out and deliver, here are five considerations to keep in mind before your team starts on development.

1. Does your customer experience support your app functionality?

Take, for instance, the case of mobile deposit capabilities. Mobile banking usage studies continue to show limited use of other mobile banking functionality beyond standard features, like balance inquiry. Despite significant benefits to the consumer and the financial institution, mobile deposit has experienced limited adoption. Only four of 10 banking customers have ever used their app’s mobile deposit functionality.

Many experts suggest a key reason for low uptake is that banks’ customer experience and related policies hamper adoption. Many banks charge for the service or impose restrictive guidelines on remote deposit amounts. According to the 2016 Mobile Bank Deposit Benchmark Report, the strength of a banks customer experience influences nearly three-quarters of a typical financial institution’s mobile deposit adoption and usage.

2. Avoid Millennial myopia

While Millennials and even Gen Z have received most of the hype and focus in discussions around mobile, don’t forget baby boomers or seniors. Forty-five percent of them actively use a mobile banking app.

What’s more, they are not as likely to jump ship. Sixty percent of boomers have been with their bank more than two years, and they are pretty satisfied. This loyalty is in sharp contrast to Millennials who are much more prone to switching.

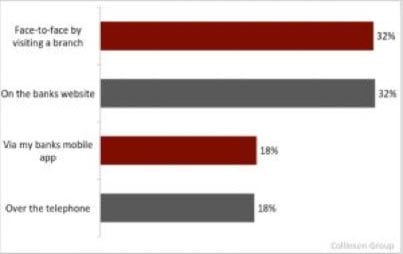

Unlike Millennials, baby boomers value multi-channel banking. They have high expectations for customer service, and they expect banks to meet their needs wherever and whenever they are. Banks that provide multi channel services demonstrate both choice and good customer service. According to the Mass Affluent Survey, baby boomers bank with different resources across the spectrum.

When considering your mobile strategy, you need to provide the same core service functionality through your mobile channels that your in-person channels provide. Moreover, the handoff between channels needs to be seamless. A Gallup study reported that fully engaged baby boomers are satisfied with 90% of their interactions they have across channels with their primary bank. On the other hand, actively disengaged boomers are happy with just 25% of their interactions. A service issue that could frustrate customers as they move from one channel to another can damage a client's overall engagement.

3. Don’t lose sight of app performance

While a simple, elegant and effective user interface is core to a delightful customer experience and often are a focus of mobile teams, apply equal weight to performance issues. Performance issues can have two levels of impact on your clients---failure or frustration. An issue at either level can lead to app abandonment.

At the failure level, app freezes or crashes, especially at key moments during a user’s session, such as scheduling a bill payment, can lead to abandonment. Studies show that 80% of users will abandon an app if it crashes more than twice. To guard against this, Apteligent recommends mobile teams should monitor the overall crash rate and the crash rate in the most important user flows within an app. In their data, they have found the best apps to have overall crash rates less than 0.25%. Start by identifying your top three user flows and focusing efforts to ensure you minimally meet the 0.25% threshold for those flows.

Secondly, mobile teams need to actively monitor and prevent app frustration. The key metric to track here is app load time according to Apteligent. Studies have shown that over 50% of users cite load time as a major source of app frustration. They recommend aiming for a load time of two seconds or less.

Banks have work to do to meet this standard. The average loading time for a banking app is 15 seconds. The Charles Schwab app loads in 5 seconds. On the other end of the spectrum, the Bank of America app loads in 30 seconds. One app contains just 6-page elements while the other loads 58. It’s easy to pinpoint which is which.

4. Safe and secure

Almost universally and even across demographics when banking customers were asked their main reservation about mobile banking, not surprisingly security was cited as a top concern. Sixty-two percent listed security of mobile banking transactions as an inhibitor to adoption in the US Federal Reserve Survey of Mobile Banking.

Bank customers appear justified in their concerns. A study by Accenture Consulting found at least one security flaw in each of 30 apps they tested from 15 different North American banks.

There are three points in the mobile technology chain where parties may exploit vulnerabilities to launch malicious attacks—the device, network, and data center. To adequately protect their mobile apps against these potential vulnerabilities, banks should take the following steps:

- Review existing security policies to ensure they align with and govern the use of mobile devices on the network.

- Configure application servers to prevent the forwarding of phishing emails or those marked as spam applications to mobile devices.

- Integrate the latest digital signature technologies into the mobile app

- Build in a password strength checker and require a minimum of 12 character passwords.

Lastly, to help establish secure practices and controls across the organization and maintain compliance, ensure you base the development process on industry frameworks such as NIST, ISO (International Organization for Standardization) 27000, FFIEC and forthcoming cyber regulations, such as the New York State Department of Financial Services.

5. Bank on change

New devices, such as wearables, are already disrupting a still maturing mobile banking environment. Recent studies show that 15 percent of banks already have or are currently deploying wearable apps. Additionally, 72 percent of banks have wearables on their roadmap into 2019.

Banks that can innovate new services, such as proximity payments, with wearables stand to gain among the Millennial market, an early adopter of wearable tech but one that is especially uninterested and unloyal to financial services companies. Over 50 percent of Millennials polled felt that there was little difference in the products and services their bank offered and the services competing banks provide, creating little barrier to the one-third who are seriously considering changing financial services providers.

Banks that can innovate new services, such as proximity payments, with wearables stand to gain among the Millennial market, an early adopter of wearable tech but one that is especially uninterested and unloyal to financial services companies. Over 50 percent of Millennials polled felt that there was little difference in the products and services their bank offered and the services competing banks provide, creating little barrier to the one-third who are seriously considering changing financial services providers.

Uncovering and implementing the next innovative services through wearables will be challenging. The small screen size and lack of keyboard make it difficult to perform tasks that require data input. As such, the functionality of wearables in the fintech space is limited to basic transactions. However, strides in voice-activated technology are helping to remedy the input limitations of wearables and are opening up the devices for innovation. Banks that can create user-friendly and hands-free functionality will set themselves apart with Millennials.

While the mobile banking space is evolving and progressing rapidly, financial services firms who keep these considerations in mind when developing their mobile strategies should be positioned well to execute quickly on the differentiating capabilities that the platform can bring.