A couple of years ago when I started hearing the term “omnichannel” being used, I just thought it was the cool new way to say “multichannel.” I was wrong.

“Omnichannel (also spelled omni-channel) is a multichannel approach to sales that seeks to provide the customer with a seamless shopping experience whether the customer is shopping online from a desktop or mobile device, by telephone or in a bricks and mortar store.” - from SearchCIO.com

So according to that definition, omnichannel is multichannel, but for one thing—that word “seamless” in there. Multichannel is about engaging through different channels—in store, mobile, social, etc. Omnichannel, by comparison, is about creating experiences that can use multiple channels to provide service to a customer. Maybe a customer does some research of your product on their phone, then fills out a form on your web site, then visits your store to complete the process. As the customer moves from one channel to another, that channel knows where the customer is in the process and starts from there, creating that “seamless” omnichannel experience.

When I recently I attended the Future Branches conference (December 2016) I heard omnichannel used a lot. Bankers there said that it is the new buzzword for 2016/17 (apparently replacing “millennial”). But from what I could tell, there was not a widely shared understanding of the term, or the impact it can have on banks.

The banks we’ve been working with and talking to recently have digital strategies in place. Those furthest along are creating a consistent customer experience across the digital channels—they either use a single product that covers web and mobile, or build custom solutions that have consistent navigation and shared visual design. Many banks also have a strategy in place for transforming their branches. These are a great start to a multichannel strategy. And you have to be multichannel before you can get to omnichannel. But I’m curious whether these banks have put the customer at the center of these strategies. Are the strategies aligned around the experience that customers expect, or just the technology?

Numerous studies, articles, and blog posts have discussed how companies like Amazon, Uber, Netflix, and others have created a new normal for customer expectations. These companies put the customer at the center of their technology decisions and use the customer’s context to better serve them. As I mentioned in my last post it is critical to understand the customer’s context to create high engagement. Let’s take a look at how this shakes out in the real world.

An Omnichannel Example

Not long ago I needed to open a small business checking account with a business partner of mine. After researching both online and traditional banks, I decided to go with my own bank (for a number of reasons that aren’t really important to the example). I looked at what I needed to do on the bank’s website, but I had some questions about opening a joint account that weren’t answered there. So I called the customer service line. They answered some of my questions and let me know that I needed to go to my local branch to open the account. I expected that, but my business partner lives in a different part of the city, and it was inconvenient for both of us to meet at a common branch. To get things rolling, I went to my branch and got my account set up. They gave me papers for my business partner to sign, which she did when we got together later that week. Then I had to take them back to my branch to get her added to the account, because the branch told me it would be easier to do it there since other branches won’t know what is going on and won’t be able to easily service us without contacting my branch, and specifically the person I worked with. Eventually, we got the joint account set up, only to find that the bank doesn’t support multiple logins to online banking, so we have to share a login.

Not a great experience.

We had to deal with multiple channels—the web, customer service (via phone), the branch, online banking—to start doing business with my bank. In each channel, I had to recreate my context for the bank to provide me service. That is a lot of work, which could drive prospects to lower-friction competitors. Hopefully, if you work for a bank and you're reading this, you're saying “we do this better.” But I suspect that, for many banks, this is not unusual.

So how might this have been done better?

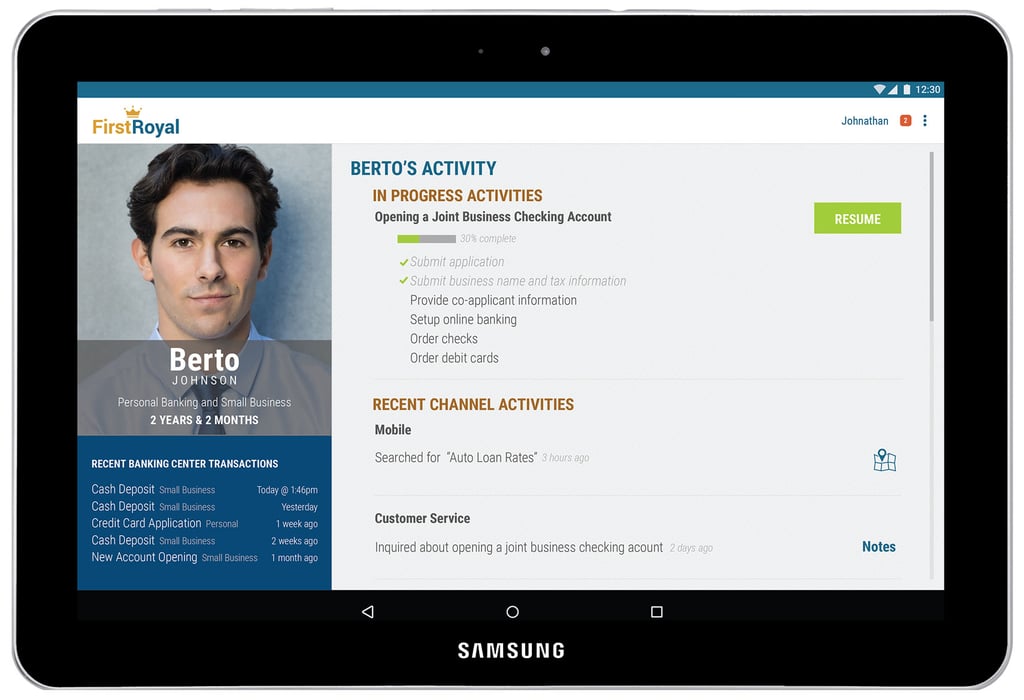

Take a look at this app. It’s something that a greeter or universal banker might use when greeting a customer at a branch.

You’ll notice that in addition to recent transactions, the channel activity of the customer is shown. Any in-progress activity, plus recent mobile and customer service interactions. Along with when the activity occurred (and where if appropriate).

Without this context, the banker might greet Berto by asking “Hello, Mr. Johnson. How can I help you today?”

Thanks to this app, when Berto walks into the branch, the banker can greet him with “Hello, Mr. Johnson. I see you are opening a business account. Are you ready to add your co-applicant? Or perhaps you are interested in talking about auto loans?”

Even if you can’t complete a process via a single channel, you can make your customers feel like you know them.

Getting to Know Your Customers: The First Step to Omnichannel

Forrester has defined 6 disciplines for CX maturity (not in the same order today as it was when this was posted, but still the same set). You’ll notice the first one listed is Customer Understanding. They say you must create “an accurate, consistent, and shared understanding of who your customers are, what they want, and how they perceive the interactions they’re having with the company today.” In other words, you have to know your customers to provide them great experiences.

But of course, you already know your customers—you have data about them in your CRM and marketing systems, your core banking systems, your issue tracking systems, and of course, in your employee’s heads.

The thing is, knowing them isn’t enough. When they engage you or you engage them, you need to understand your customers' context to give them what they need, when they need it. In Disrupting Digital Business, Ray Wang talks about how knowing your customer at scale must be automated, or it is too costly. Your view of the customer must be consistent, accurate, and individual. You can’t afford to lose their trust by referencing out-of-date information about them, or treating them like all of your other customers. The context needed to engage them fully includes the role they are playing at the time, the date and time of day, the location they are engaged, and other factors. Is this information available in real time like the app above shows? If not, how do you get it?

In addition to experience design, a digital strategy for building an omnichannel experience for your customers includes several foundational technology elements. They’re sometimes neglected, but these elements are critical to being able to move quickly and realize the desired experiences. In our project work, the Summa team has helped clients with the strategy and implementation work that established the foundation for system integration, APIs, and Master Data Management (MDM) to support future growth. Through a combination of good API design and MDM, you will have the basic capabilities that allow creation of the unified customer view. Currently, there are not good one-size-fits-all, singular banking software packages that enable all channels, so your customer information and context is likely spread across multiple systems. To get that unified view, as well as the customer’s context, you need to pull the information from these systems. MDM handles the unified view by defining what data makes up a customer, how that data is related to other data, who can get at the data, and how the data is managed. You may define your CRM to be the master of the customer data, or a dedicated MDM solution that acts as your master of customer data (as well as master for other kinds of data). Either way, you need to govern the master data to ensure it is clean, consistent, and accurate. And to make this an efficient, scalable solution, you need to automate the governance as much as possible.

To get customer data from multiple sources, you will need to reach into those systems to extract the data, possibly augment that data from other sources, apply cleansing and consistency rules to it, and move it to the master data store. For value, the data must also be kept up to date and shared across systems. This takes a solid systems integration and API strategy to avoid a jumble of fragile and difficult-to-manage point-to-point solutions. Once that beautiful customer data is stored, you’ll want to make it available for other systems to use by exposing it using well-designed, highly usable APIs.

Creating a consistent view of customers and their context creates significant technical challenges. Importantly it also challenges a business’s culture and organization structure. But to get to the point where a customer can walk into your branch and your employees know their context and can provide them with great experiences, it is critical to solve these problems. It will be helpful to have an experienced partner guide you through this change. Contact us if you’d like to talk about how we can help you get started on your omnichannel journey.

Digital is reinventing banking. Are you ready?

Key digital transformations can help your organization stand out and provide unique customer experiences.