Recent innovations in payments

Thanks to recent innovation by FinTech companies, the ways you can transfer money looks drastically different than it did even a decade ago. Today, you’re more likely to see someone paying with their cell phone than writing a check.

Despite these new methods of payment looking quite different, the underlying networks and methods that these apps use are still quite dated. This means that even though a fancy new payment app looks like it’s exchanging money in real-time, in reality it’s not.

For example, if you’re splitting the dinner bill with friends through Venmo, your payment is actually traversing the ACH payment network. This is the same as sending an electronic check. When you go to transfer money from your Venmo account to your bank account, you have to wait the standard transfer time, which could be 3 or more days, before you can use your money. In the meantime, your friend could go to his or her bank and stop the payment on their end.

What is the answer? For banks, should we go back to encouraging customers to meet at a branch and exchange Cashier’s Checks? Money Orders? Wire Transfers?

There needs to be a better answer. And something that financial institutions and their customers can trust.

Meet Zelle: the new kid in town

Enter clearXchange, the US based digital payments network that arrived on the scene in 2011. Owned by banks, it is a major effort to simplify and improve digital payments. After Early Warning acquired clearXchange in the beginning of 2016, they have rebranded their digital payment solution, now known as Zelle.

Early Warning announced in April 2017 that financial institutions in the Zelle Network processed more than 170 million P2P payments in 2016 - totaling $55 billion in aggregate transaction value.1 In addition, the network grew to 20 banks and credit unions and is poised to reach about 85 million U.S. consumers through the mobile banking apps of its member institutions.

Since the major banks own Early Warning, Zelle is effectively owned by banks. This ownership structure is a major distinguishing factor. Zelle will enable customers to move money directly between accounts, instead of having to move money to a separate account first, which is the case for services like Venmo and PayPal. On top of this, for users that bank with any of the integrated banks (on this quickly growing list), their payments will actually transfer in real-time. Behind the scenes, the money is still transferring between bank accounts via the traditional methods (FedACH), but Zelle participating banks have agreements in place to immediately credit and debit their customers’ accounts in real-time, and will settle discrepancies as necessary. This is completely abstracted from the customer, however, and means that the customer can immediately use and withdraw the real-time funds.

Since the major banks own Early Warning, Zelle is effectively owned by banks. This ownership structure is a major distinguishing factor. Zelle will enable customers to move money directly between accounts, instead of having to move money to a separate account first, which is the case for services like Venmo and PayPal. On top of this, for users that bank with any of the integrated banks (on this quickly growing list), their payments will actually transfer in real-time. Behind the scenes, the money is still transferring between bank accounts via the traditional methods (FedACH), but Zelle participating banks have agreements in place to immediately credit and debit their customers’ accounts in real-time, and will settle discrepancies as necessary. This is completely abstracted from the customer, however, and means that the customer can immediately use and withdraw the real-time funds.

Zelle works with any demand deposit account (DDA) account, however, as long as the user can link his or her debit card to their Zelle account. The only downfall when one or more of the transacting parties are out-of-network is that the transaction can no longer occur in real-time.

Convenience and security for banks and customers

Instead of fundamentally changing the way that money moves, Zelle is really a directory of users and accounts that is accessible to all banks that integrate with their service. The benefit to banks is that they don’t have to change their existing payments infrastructure to give customers an easy way to transfer payments in real-time. Zelle is built on top of the existing payment infrastructure already in use at banks today.

Convenience extends to consumers, too. Once a user gets a Zelle account, it will stay with them even if they change banks in the future.

A security benefit to using the Zelle network is that, for two people to exchange money, they don’t have to exchange bank account information. Rather, they simply need to find each other in the Zelle directory (searching by phone, or email, etc.). When they identify that they want to send funds to that individual, Zelle will determine that contact’s corresponding bank information behind the scenes, hidden from the transacting parties.

While Zelle is initially launching with the intent of being a peer-to-peer (P2P) payment provider, I speculate that the goal is to eventually expand the service to allow businesses to make payments with the app as well. Having an easy-to-use, informative smartphone app to checkout and manage receipts will simplify keeping track of payments.

What makes Zelle different

When using a payments app like Venmo or PayPal, it’s not entirely clear what happens when something goes wrong. Often, their customer support will instruct the customer to follow-up with their bank, causing the customer to restart the support process with a different institution. An undoubtedly frustrating experience.

Since it is owned by banks, in the unfortunate event that something goes wrong, such as a user’s identity being compromised, the customer is able to talk directly to his or her bank, as opposed to having to bounce between a separate app’s customer service and the bank. With Zelle, customers are able to cut out the middleman and reduce the complexity of the payment process. By dealing directly with their bank, customers get the added security and familiarity that they otherwise would not.

Additionally, when both Zelle members are banking with an in-network bank, their funds are actually transferring in real-time. This is thanks to agreements between all “in-network” banks, and distinguishes Zelle from existing payment apps. It is the only app that can give the user the ability to move funds between actual bank accounts in real-time.

What’s in it for banks

There are three main benefits for banks who implement a Zelle-based real-time payments service. These touch many facets of the bank, including new opportunities for revenue generation, ease of implementation compared to other competing platforms, and soft benefits that build the brand

Recapture lost interest incomeWhen a consumer opens an account with a third party payment app like Venmo or PayPal and receive payments through that app, the funds sit in a separate account until the user manually initiates the transfer back to their bank account.2 As it’s pretty common for these third party apps to be used to send and receive funds, often users won’t transfer funds out at all. This translates to a large amount of customer funds leaving banks. Instead of the banks gaining interest on customers deposits, this interest goes to the third party app company.

Faster implementationBecause Zelle is owned and designed by banks, they tailored the integration experience to be as straightforward as possible while minimizing the impact to legacy systems. Since Zelle is a network that sits on top of the bank’s existing payment network, banks can leverage their existing payment networks to bring new value to their customers and roll these services out quickly. As there are many banks that have already integrated to Zelle, it’s a tried and proven system with much of the early growing pains resolved and ironed out.

Position the organization as an innovation leaderFinally, Zelle can position banks as innovative service providers helping to separate themselves from laggards in their competitive set. When a bank integrates with Zelle, they integrate it directly into their existing bank applications for a native or co-branded experience. Customers can leverage the full Zelle network of benefits from within a bank’s own app, associating that bank as a co-leader of innovation. This means that customers won’t have to download a separate application, or sign up for a separate account. With the barrier to switching banks decreasing every day, integrating customers with a high value-add service like Zelle is a way banks can fight back and increase customer loyalty.

Summa’s experience with Zelle

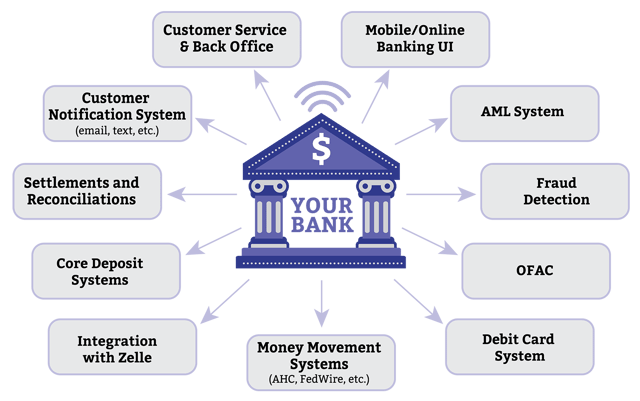

At Summa, we help banks bring the future of digital payments to their customers. We recently helped a top 10 US bank integrate Zelle into their existing mobile applications and website, enabling them to better compete with nonbank payment providers. Summa implemented the end-to-end, real-time P2P payments solution, including payment origination, P2P payment processing, a custom administrative system, and integration into the bank’s many other computer systems.

Because of our leadership role, we knew who needed to get involved early on to make the project a success. The Zelle integration touched many systems of the bank, and it isn’t always immediately clear what the impact of integrating a real-time payments (RTP) system will be.

As a result, we were able to seamlessly integrate the Real-Time Payment capability directly into their existing mobile app and website, for a seamlessly integrated Zelle experience for the customer.

From the formation of a bank’s project team to determining the order in which to best integrate the various systems of a bank to Zelle, we are experienced on what needs to happen for a timely and successful integration to occur.

You can rely on our expertise to help you successfully bring real-time P2P payments to your customers. We identify what pitfalls to avoid and the best integration strategy. Reach out today and let’s have a conversation on what the future of digital payments looks like for your bank.

Sources:

- https://www.earlywarning.com/news/press-releases/2017/zelle-network-banks-process-170-million-p2p-payments-totaling-55-billion-in-2016.html

- https://venmo.com/legal/us-user-agreement/